Payment Gateway Integration – Right Solution for Your Online Transaction Platform

Introduction of Payment Gateway Integration

Before a decade the phrase “payment gateway integration” was familiar in the eCommerce market. Nowadays, the scenario has completely changed. Customers expect that the shopkeeper should have a debit credit card swiping machine or UPI code generator. Moreover, online transactions are possible by the use of payment gateways.

In the era of digital marketing, digitization payments have increased. Small shop owners, travel agents, eCommerce business owners have accepted the concept of payment gateway integration to increase clients and to increase their revenues too. Payment Gateway Integration required a bank linking with the website in order to allow customers to pay directly from the account.

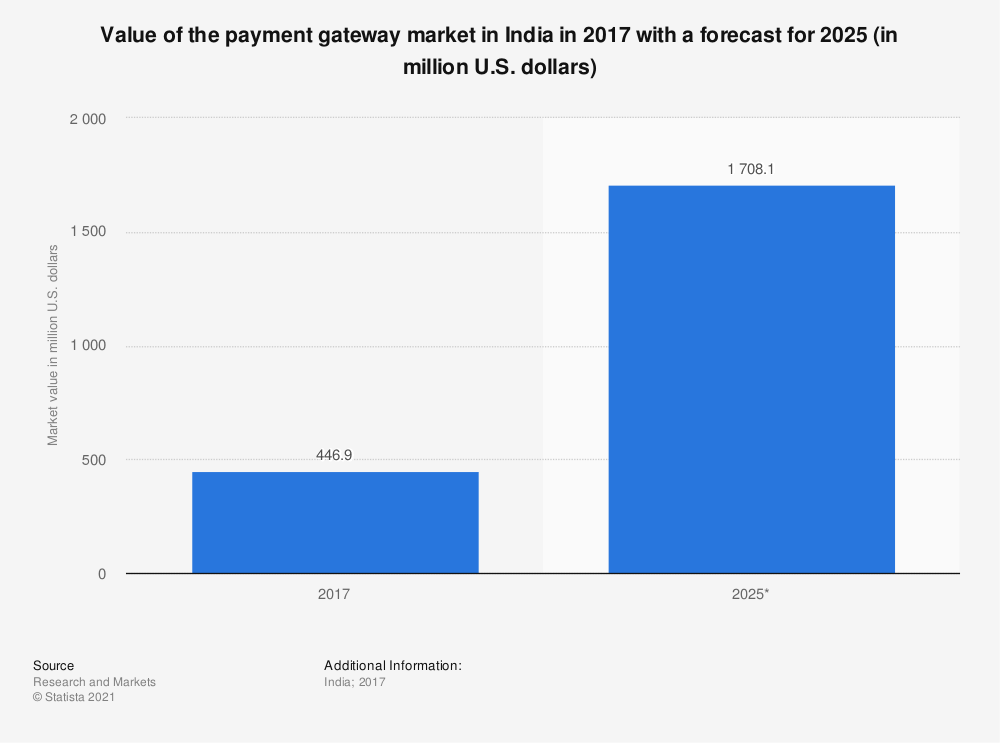

A research conducted by statista shows that the payment gateway market in India in 2017 stood at $446.9 billion and is forecasted to grow upto $1708.1 billion in 2025.

What is Payment Gateway Integration?

Payment Gateway Integration is a service that processes payments directly through an application or a website by linking your bank account. Payment gateway transfers the key information between mobile devices/websites and payment processors via bank and vice versa. Think of the payment gateway as a tool and you can deal with the financial transactions online without the involvement of any third party.

How does Payment Gateway work?

Once a purchase is made, the electronic payment method sends the consumer’s account details, from which money needs to be deducted, to the merchant purchasing bank, post this, the transaction gets processed.

Let us understand it by taking an example –

Mr. A is a customer of an eCommerce platform i.e. Amazon. He purchased an X item from the Amazon store. The billing procedure is done through an eWallet, for e.g. Gpay, the customer needs to select the mode of payment and pay directly through the Gpay app and the amount will directly be credited into the merchant’s bank account. This entire process will maximum up to 3 seconds, without the involvement of a third party.

The design of payment gateway depends upon store gateway or an online payment platform. For developing payment gateway Application Programming Interfaces (API) is mandatory.

How to Integrate Payment Gateway?

For integrating payment gateway, developers can follow main standards. Here’re the 2 major standards that developers can consider while integrating the payment gateway function in the ecommerce website or application.

- Developer must be in compliance with any financial regulation i.e. (PCI,DSS)

- The user experience should be pleasant with the payment procedure and checkout process.

So these are the two factors which matter while integrating payment gateway.

Top Benefits of Payment Gateway Integration

1. Secure Transaction

The prime benefit of integrating payment gateway is, it saves your time, ensures transaction security and speeds up the payment processing environment. Online payment gateway helps you to receive payments nearly 50 times faster than normal payments.

The approval of the payment takes a fraction of second from the merchants and customers end. As they need not wait for long to complete the transaction.

2. Rock Bottom Set Up Cost

There are people who think that setting up an online payment method is costlier and it can only be afforded by big businesses. However, that’s not true. Payment gateway incurs a specific amount of transaction charge, and in the end those charges are worth it. The initial set-up of the most reputed payment gateway is affordable.

3. Time is Money

We live in the age of bullet trains and high speed jets. We all want to make the most of our time available. That is the biggest reason online payments are accepted and loved by users. No matter which country you are in, you can make and receive payments via an online payment gateway.

4. Improves Customer Experience

Through the payment gateway integration, customers get to choose from a variety of digital payment options. If the customer can’t locate his favorite payment option, high chances are he will check out from the page on the spot and shop from the competitor’s website/app.

So, the website that offers various multiple types of payment methods, along with faster and secure transactions, is always valued by the customers.

Step to follow while Selecting Payment Gateway Integration

Now you’re on the path of learning how to create a payment gateway for any website. Let us see what exactly the market has to offer in terms of a gateway. It always makes sense to know completely about the integration of payment gateway from scratch.

1. Hosted Payment Gateway

The hosted payment gateway will take the customer away from your website to complete the payment and then redirect them back once the process is done. There are two examples of hosted payment gateway i.e. Paypal and 2Check out. Hosted gateway is responsible for security and maintenance issues. With that hosted payment gateway it is much easier to integrate into your website.

2. Integrated Payment Gateway

Application Programming Interface (API) used by integrated payment gateway to connect your business for payment gateway services. This is also referred to as non-hosted payment gateways. Such types of gateways are also mobile friendly. If your website shows bugs, you may be subject to audit.

In demand Payment Gateway Providers

There are various kinds of payment gateway providers in the market. Here we have covered the biggest and most reliable.

1. PayPal

PayPal as a payment mode is accepted worldwide. It always offers logical and scalable solutions for businesses of different sizes. With the help of a payment gateway, PayPal offers options to choose from major debit and credit cards along with its own payment option, PayPal payments.

PayPal is integrated with a hosted payment solution. It gives you an option of PayPal Pro to upgrade if you want an integrated check out right on your website. It is the easiest option as PayPal simply adds a PayPal button to your site.

2. Amazon Pay

The first giant eCommerce payment gateway designed for online retailers is Amazon Pay. Like any other payment gateway, Amazon pay is integrated through an API by offering a semi-integrated payment solution. Amazon pay has more focus on mobile usage but it is available across devices. It also supports all major payment methods and credit cards too.

3. Stripe

Stripe is an eCommerce customized payment gateway solution. It accepts all payment transaction methods including payment providers like Apple Pay, WeChat Pay and Android Pay. There is a thin-line difference between other payment gateway and stripe i.e. it doesn’t have an out of the box solution. Instead of that Stripe provides you a range of flexible tools that customize your own payment process.

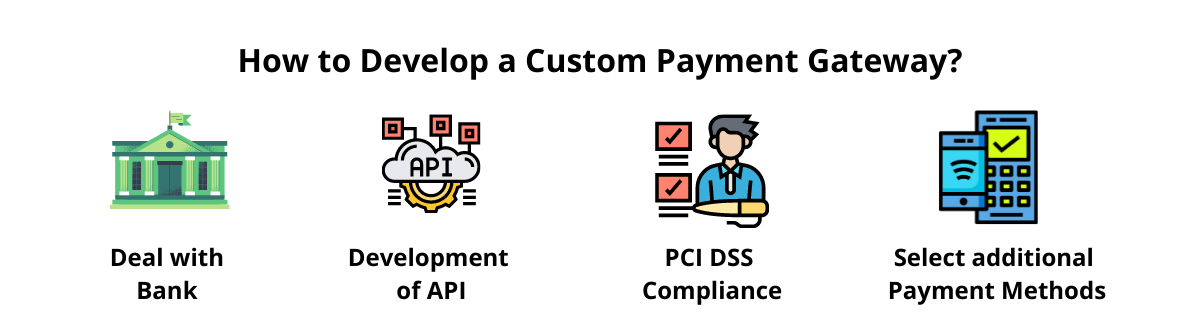

How to Build a Custom Payment Gateway?

To create a custom payment gateway you need to follow various steps

1. Deal with Bank

Before payment gateway integration it is important to deal with banks by doing contracts. After the payment gateway integration, the bank will handle the actual processing for you. Every bank has their own transaction policy, here also you will get the different transactions for international transfers or may be different rates for currency exchange.

2. Development of API

Develop an API for the gateway you choose and make sure you write robust documentation as required with PCI DSS compliance.

3. PCI DSS Compliance

PCI DSS compliance implements all the necessary security measures and integrates merchant fraud protection mechanisms on your website.

4. Select additional Payment Methods

You’ll need to integrate payment methods separately with their APIS. The additional payment methods like PayPal, Bitcoin, mobile wallets and so on.

Bottomline

You have vast choices available to integrate a payment gateway into your website or application. Customers trust those websites which have an inbuilt payment system. As an organization or an individual if you’re looking for a way to improve clients confidence, we highly recommend you to integrate a payment gateway which inspires your client to trust you and your website.

OneClick provides you the payment gateway integrations that will allow you to conduct real-time financial transactions in a stable, adaptable, scalable and secure environment.