Data Analytics in Accounting: The Ultimate Guide for 2026

Within the field of accounting, data analytics is becoming more and more significant. Though accounting data analytics has existed in one form or another since antiquity, it may seem unlikely that something significant is about to happen.

Undoubtedly, the accounting field and its related fields have evolved over time, but maybe not as much as you might expect. Let’s examine how accounting uses data analytics.

What Is Data Analytics in Accounting?

In short, data analytics is the process of analyzing data. It’s a subset of business intelligence (BI), which is itself a subset of business analytics (BA). Data science and BI are both focused on analyzing large amounts of structured data to uncover patterns or predict future events.

However, while BI uses algorithms to draw conclusions from that information, data science can also use unstructured information like images and text as well as structured information like databases.

Accounting has always, in general, depended on gathering and evaluating data. But now that sophisticated algorithms and potent software have been developed, technology is far more advanced than any accountant could have ever been.

Accountants can use data analytics to make better decisions; they can gain insights into how their company is doing and where it might be headed. And this isn’t just true for larger companies even small businesses can benefit from taking advantage of these new technologies.

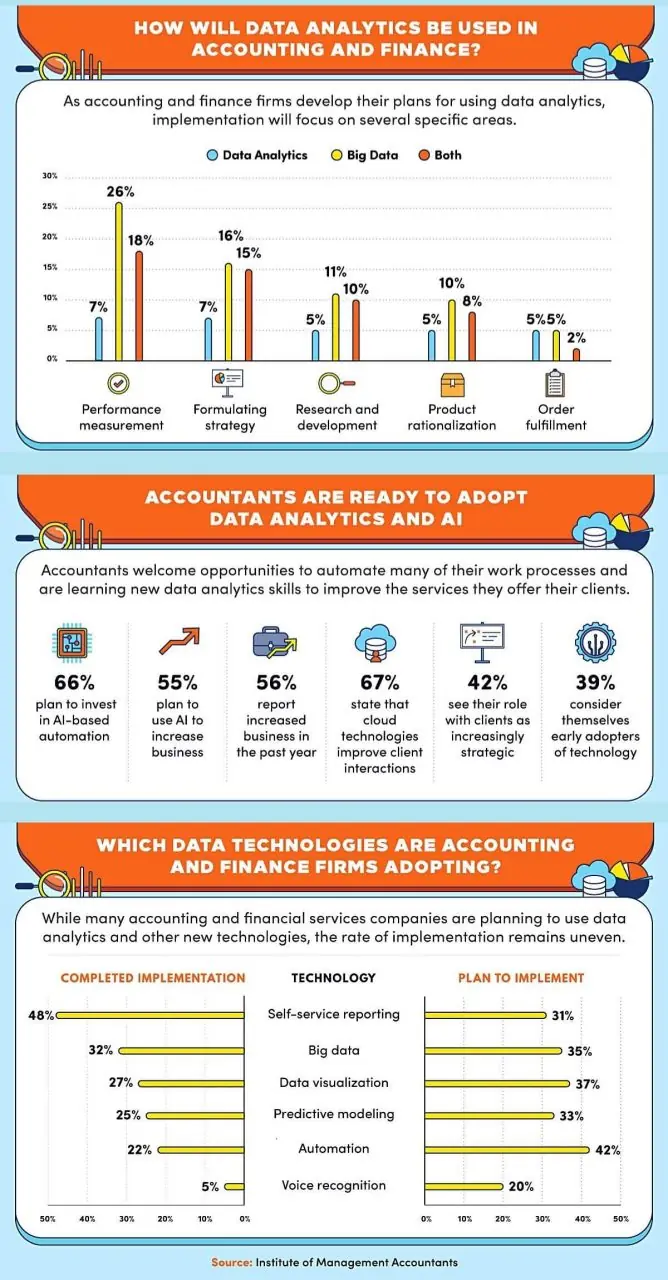

Accounting Data Analytics Stats of 2026

The following are some of the most important statistics related to data analytics in accounting.

Reasons Why Companies Need Data Analytics in Accounting

Data analytics is a powerful tool for businesses, and the accounting industry is no exception. When you use data analytics to understand your company’s financial health, you can make more informed decisions about how to grow it, improve it, and keep it running smoothly. Here are three major reasons why data analytics in accounting is so important.

1. It helps understand your customers better.

Customers are a business’s most vital component. Your ability to assist customers and expand your business will both improve with more knowledge of them and their demands. You can gather data using data analytics on the preferences, spending patterns, demographics, and other characteristics of your clients. This information can be used to inform marketing campaigns and product development, among other things.

2. It helps track your performance against competitors.

Competitive intelligence is crucial for any business looking to stay ahead of the curve. data analytics for accounting allows you to see how your competitors are performing financially and what strategies they’re using so that you can make informed decisions about where best to invest or reallocate resources.

3. It helps with strategic planning.

In today’s fast-paced world of business, it’s easy for companies of all sizes even large ones to lose sight of their long-term goals in favor of short-term gains. This will help them set goals and plan accordingly.

Importance of Data Analytics in Accounting

With the volume of information that businesses need to manage, it’s no secret that data analytics is a powerful tool for accounting. Accounting software, in particular, can help you manage your finances by providing you with insights into your spending habits and cash flow.

But what does this mean for your business? Here are important ways data analytics for accounting can help you in financial health:

1. Data Analytics Help You Manage Your Financials.

Data analytics can help you monitor your financial health by providing insights into your sales and expenses.

For example, if your business is seeing an increase in sales but not enough profit, data analytics for accounting can help you identify which products are selling well and which ones aren’t. This will allow you to make changes accordingly and improve profitability.

2. Data Analytics Help You Plan for the Future.

With data analytics, you’ll have access to historical information about previous years’ sales and expenses so that you can predict how much money will be coming in next year or how much it will cost to run the company over the next few months and even years!

This way, if something unexpected happens (like a major economic downturn), then you’ll know exactly how much money will be coming in and going out so that it doesn’t impact operations too severely.

3. Data Analytics Help Identify Trends and Patterns.

Identify trends and patterns in your company’s financial information that may not be apparent at first glance. This allows you to make better decisions about how the business is run, which will ultimately save you time and money.

Key Tools Used in Accounting Data Analytics

1. Accounting software

This is the most common tool used by businesses to record and analyze the financial data of a company. It helps in automating tasks, reducing errors, and improving efficiency.

2. Spreadsheets

Spreadsheets allow users to view data in a graphical format so that it can be easily interpreted. It helps users perform calculations on large sets of data quickly by using formulas and charts.

3. Data mining tools

Data mining tools are used to extract useful information from large volumes of unstructured data using various methods like statistical analysis or artificial intelligence algorithms.

4. Visualization tools

These are the tools used to present your data understandably so that other people can understand it easily. They include graphs, charts, and maps.

5. Statistical analysis tools

They allow users to perform statistical analyses on large sets of data to identify relationships between variables such as sales volume and price changes over time or sales volumes across different regions within an organization’s market area.

6. Advanced reporting tools

These tools provide a user with more advanced options than traditional reporting tools do (i.e., they allow users to create customized reports based on specific criteria).

7. Machine Learning

Machine learning is a subfield of computer science that gives computers the ability to learn without being explicitly programmed. The process involves algorithms and statistical models that allow computers to improve their performance over time as they encounter new data.

8. Natural Language Processing (NLP)

NLP is used for automated text classification and understanding, including sentiment analysis (positive or negative), topic identification, and entity recognition (e.g., names).

Challenges Faced When Implementing Data Analytics In Accounting

Data analytics has been around for a while now. It’s been used by marketers to predict consumer behaviour and by financial analysts to detect fraud, but it’s only recently that it has started being applied in the accounting field.

And yet, even though data analytics is becoming more and more of an integral part of accounting, most businesses still haven’t implemented it. Why? There are still several challenges you’ll have to face before implementing data analytics in your business.

These challenges include,

1. Time constraints

Data collection takes time and effort. And even after you collect the data, there’s still more time required for analysis. So this is something you should consider before trying out any new strategy or system in your business.

2. Lack of expertise

If you don’t have enough people with expertise in this area on your team, then implementing data analytics might be difficult for you. This is because gathering and analyzing data requires someone who knows what they’re doing!

3. Lack of appropriate infrastructure

Data analytics requires good infrastructure to support it. This can be achieved by using cloud services such as AWS that offer better scalability and cost-effectiveness compared to traditional on-premise solutions.

4. Lack of budget for implementation

Another challenge faced when implementing data analytics is the lack of budget for implementation. Many businesses do not have enough funds required to implement their in-house system or third-party software solution which may require additional investment from them apart from their existing expenses towards payroll processing etc.

Conclusion

However, it might seem odd to consider that accounting, a field that has been in some form or another since antiquity, could be about to undergo a significant change. Isn’t everything the same as it ever was?

No, is the response. The field of accounting is developing so quickly that data analytics will soon be used by accountants for all tasks. Not only accounting, but the whole business sector is undergoing significant change as a result of technology.

FAQs on Accounting Data Analytics

Data analytics is a process that uses algorithms to extract and analyze information from large amounts of data. Accounting data analytics is a subset of this process where the information extracted comes from financial transactions, such as invoices, payments, and receipts.

Accounting data analytics allows businesses to make informed decisions based on the analysis of this information.

You can access accounting data analytics through your company’s software or by using an outside service provider.

Some examples of accounting data analytics include stock price analysis, which allows you to see how your company’s shares have performed over time, and cash flow analysis, which shows you how much cash is coming in and going out each month.

The software supports all of the most popular accounting formats, including CSV, JSON, and Excel. If you have a file that isn’t one of those formats, it may be possible to convert it with a third-party tool like Google Sheets or Google Drive. The online documentation has more details on this.

The benefits of accounting data analytics include better management decisions based on current information; improved communication between departments; increased transparency into financial performance; faster access to key metrics; and more opportunity for employees to learn new skills through training programs that are tailored specifically around their needs.

First off, you’ll need access to all of your financial information including bank statements, sales receipts, invoices, and payments in one place where it’s easy to find and manage.

You will also want a place where you can store any documents related to the transactions happening within your company (like contracts with suppliers or employees).

Many businesses use accounting software to record and track their financial transactions, but they don’t always know what to do with that data. Accounting data analytics helps you make sense of your company’s financial data by providing insight into how it relates to other aspects of your business.

Financial data analytics focuses on the data being collected by your financial software, such as accounts payable and receivable, cash flow reports, and budgets. These are metrics that are important for companies all over the world, but that doesn’t mean they’re relevant to your business.

Companies use their accounting data to make strategic decisions, like whether or not to acquire another company. They can also use it on a day-to-day basis, like deciding whether or not to purchase a new piece of equipment.

No! Accounting data analytics is a tool that can be used by anyone in any industry who wants to learn more about their business by analyzing their financial data.

Companies use it because it helps them make better decisions about which areas need improvement and how best to approach those improvements.

If you’re looking for ways to improve your business’s bottom line, accounting data analytics can be helpful. It allows you to predict future trends and make smarter decisions about how much money you should spend on certain things or how many employees you need to stay profitable.

Metrics that are important for one business may not be important for another business. It depends on what your business is trying to achieve, and what kind of information helps you reach those goals.

For example, if your goal is improving customer satisfaction, then metrics like customer complaints or returns might be more important than metrics like sales volume or profit margin.